A hammer suggests that a down move is ending (hammering out a bottom). Note the long lower tail, which indicates that sellers made another attempt lower, but were rebuffed and the price erased most or all of the losses on the day. The important interpretation is that this is the first time buyers have surfaced in strength in the current down move, which is suggestive of a change in directional sentiment. The pattern is confirmed by a bullish candle the next day. Traditionally, candlesticks are best used on a daily basis, the idea being that each candle captures a full day’s worth of news, data, and price action. This suggests that candles are more useful to longer-term or swing traders.

Rather, it indicates that a reversal is likely to occur in the near future. The pattern is created by three trading sessions in a row with gaps in between. While each candle doesn’t necessarily have to be large, usually at least two or three of the candles are. Learn to take profitable trades with my price action trading course. For a bearish Hikkake, the next candlestick must have a higher high and higher low. When this bullish break-out of the inside bar fails, the market forms a short Hikkake setup.

The Four Basic Elements of a Candlestick

If you recognize a pattern and receive confirmation, then you have a basis for taking a trade. Let the market do its thing, and you will eventually get a high-probability candlestick signal. Candlestick patterns are one of the core methods of price action trading.

The Hammer and Shooting Star are reversal candlestick patterns that are characterized by a small body and a long lower shadow. The Hammer occurs after a downtrend and indicates a potential bullish reversal, while the Shooting Star occurs after an uptrend and signals a potential bearish reversal. Candlesticks provide a wide range of visual hints and thanks to them we can understand price action trading in a much easier way. Time frame trading with Japanese candlestick charts also allows traders to grasp market sentiment.

What is Forex Price Action Trading? – Benzinga

What is Forex Price Action Trading?.

Posted: Mon, 26 Jun 2023 07:00:00 GMT [source]

However, you should familiarise yourself with one pattern before moving to the next. Trying to look out for dozens of patterns without knowing what they are trying to tell you lands you in a confusing mess. Both the Hammer and the Hanging Man patterns look exactly the same. The body of the second candle completely engulfs the body of the first.

San-Ku (Three Gaps) Pattern

Shooting Star – The distinguishing feature of a Shooting Star is a Long Upper Shadow, a small to no lower shadow, and a small body. Also, the long upper shadow is usually at least twice the size of the body. By the way, if you easily get tired of staring at Forex charts, what you need is this chart overlay indicator that gives your MT4 a fresh, modern look. The indicator also makes your chart look more compact and easier to analyze. Let’s first take a look at the basics of candles so you can understand the various parts of a candlestick. Remember the risk of trading Forex & CFD – it’s one of the riskiest forms of investment.

Price Action Trading Techniques Lessons in FREE FXGlobe Webinar – EIN News

Price Action Trading Techniques Lessons in FREE FXGlobe Webinar.

Posted: Thu, 07 Sep 2023 12:56:00 GMT [source]

Gravestone Doji – The Gravestone Doji is a Bearish Candlestick Pattern. The low, the open, and the close, are the same or they’re very near each other. Low, Open and Close are the same or very near each other. Dragonfly Doji – As the name suggests, this pattern resembles a dragonfly.

Master Guide on CandleStick Patterns

The shooting star and inverted hammer are similar to the hammer and hanging man patterns, but they have long upper wicks instead of lower wicks. The shooting star appears after an uptrend and signals a potential bearish reversal, while the inverted hammer appears after a downtrend and signals a potential bullish reversal. Traders often look for confirmation from other technical indicators or candlestick patterns before making trading decisions based on these patterns. In conclusion, mastering the top candlestick patterns in forex trading can greatly enhance a trader’s ability to analyze the market and make informed trading decisions. By studying and recognizing these patterns, traders can gain valuable insights into market sentiment and potential trend reversals. However, it is important to remember that candlestick patterns should always be used in conjunction with other technical indicators and price action analysis for more accurate predictions.

The morning star and evening star are three-candlestick patterns that indicate potential trend reversals. These patterns are considered strong signals when they appear near support or resistance levels. Bullish and bearish engulfing patterns are one of the best Forex candlestick patterns to confirm a trade setup.

Morning Star Candlestick: A Forex Trader’s Guide

Traders should look for confirmation from other technical indicators and price action before entering a trade based on these patterns. In this way, you will get something more than a list of patterns that you can apply on the market, you will https://g-markets.net/ understand how and why prices move through the study of the candlesticks. This will help you not only to understand the direction of the market, but also to place reasonable levels of stop loss and take profit and manage your risk properly.

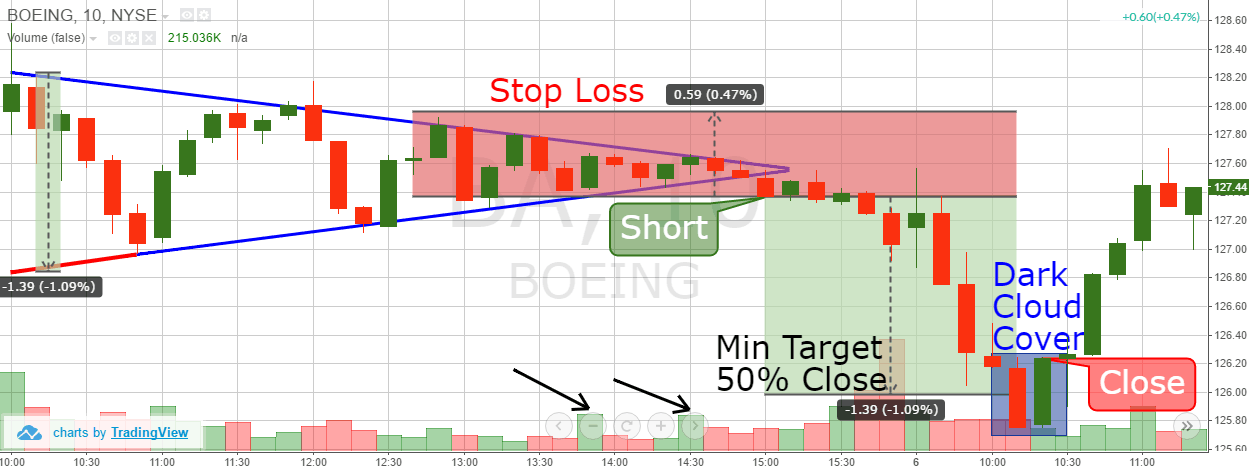

The chart above shows a bullish pennant pattern which is confirmed by a bullish engulfing pattern. Once the engulfing pattern forms, a trade could enter in the direction of the pennant breakout. A three inside down pattern is shown on the following chart. The solid body of a candlestick shows the open and close prices of a trading period, while the upper and lower wicks of the candle represent the high and low prices of that trading period.

The Hammer pattern is found after a market decline and is a bullish signal. However, the Hanging Man appears (as an ill-omen) at the end of a bull run and is a bearish signal. Its opening price and closing price are at the extreme ends of the candlestick.

A wick at the bottom of the candle could indicate the end of the downtrend for instance. Keep in mind that this is totally normal as long as the discrepancy is not too contrast. It doesn’t necessarily mean that one of the brokers is providing a false or less accurate chart than the other. Such condition is generally caused by the differences between the brokers’ server time. A broker with earlier server time would precede other brokers in the candlestick formation.

- The Marubozu is more useful as a learning tool than as a pattern for trading.

- Learn to take profitable trades with my price action trading course.

- The Harami Cross pattern consists of a bullish or bearish candlestick at the top or bottom of its trend, followed by a Doji that remains within the range of the previous candlestick.

- Each bar represents a specific duration where the price has moved, starting from the Open until the Close.

A hanging man pattern looks similar to a hammer pattern, with the only difference being that it forms at the top of an uptrend. In this case, a hanging man pattern shows that selling pressure is growing – represented by the long lower wick – despite the uptrend. Candlestick formations in Forex truly represent the psychology and sentiment of the market.

Before we dig deeper into candlestick patterns, it’s important to understand how Forex candles are formed. Forex candles, or the candlestick chart, are OHLC charts, which means that each candle shows the open, high, low, and close price of a trading period. A hanging man pattern suggests an important potential reversal lower and is the corollary to the candlestick patterns to master forex trading price action bullish hammer formation. The story behind the candle is that, for the first time in many days, selling interest has entered the market, leading to the long tail to the downside. The buyers fought back, and the end result is a small, dark body at the top of the candle. Confirmation of a short signal comes with a dark candle on the following day.

According to Thomas Bulkowski’s Encyclopedia of Candlestick Charts, there are 103 candlestick patterns (including both bullish and bearish versions). While the encyclopedia is great for reference, there is no need to memorise the 929-page compendium. Supplement your understanding of forex candlesticks with one of our free forex trading guides. Our experts have also put together a range of trading forecasts which cover major currencies, oil, gold and even equities. This means that each candle depicts the open price, closing price, high and low of a single week.