Each package option includes a specific timeline for the project’s completion. During the follow-up meeting, review your recommendations and detail the project’s scope. Take advantage of technology by sharing your screen as you explain what’s involved.

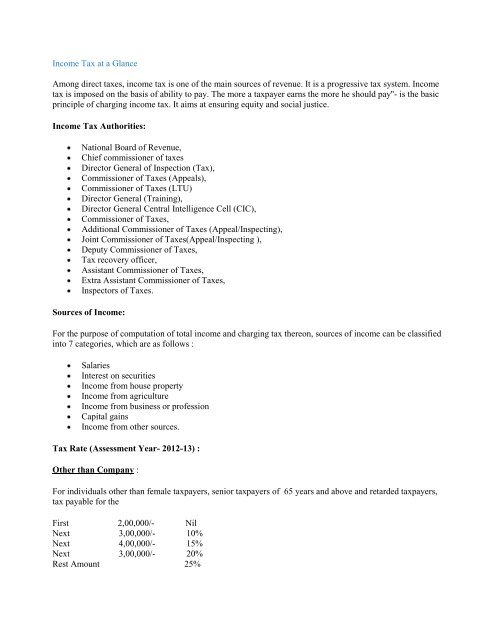

This not only helps us keep everything on track, but allows us to work through problem areas and identify opportunities. One of the most hectic times is during the time of taxation and audit. Many people take it lightly, but irregularity and error in the accounting system can be disastrous for any business.

Why Your Business Needs Accounting Clean Up Services

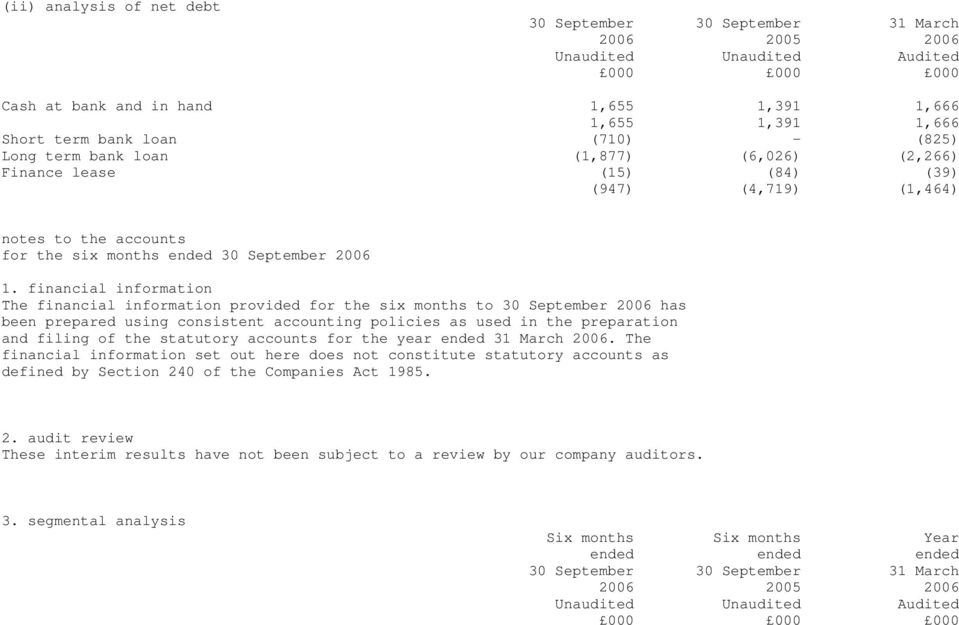

Not only will you pay less in clean up costs, but you can avoid penalties, maximize deductions, and make better financial decisions, making for a great return on your investment. Poor bookkeeping can also result in tax errors and penalties, missing out on tax deductions and credits, and an increased risk of an audit. By checking your tax returns, you can ensure that all taxes have been paid on time and that all necessary paperwork has been submitted accurately. To avoid any fines or interest costs, it’s crucial to constantly verify your tax files. The payments you make to your employees, such as salaries, wages, and deductions, are documented in your payroll records.

- You can self-pay on the IRS website or talk with your accountant about how to determine the amount of taxes you should be paying quarterly.

- A clean up plan establishes the proper order of adjustments to avoid blunders, excessive corrections, and duplication of work.

- What’s the big deal if your books are a little messy, anyway?

- If you know how to manage your books correctly from the start, that is.

- Be sure you understand the cleanup plan before allowing execution to begin.

- Sloppy or incomplete books may even prevent a business from qualifying for the loans, lines of credit, and investor funding on which its future growth rests.

Whether it was competency issues or human error, you need clean-up bookkeeping. Most Bookkeepers and Accountants don’t enjoy clean-up bookkeeping projects. We’ve found that less than 20% of bookkeepers enjoy this and only about 10% have the requisite training and experience to be effective at it. Because we specialize in clean-up and catch-up we have developed tools, software and processes that make us faster and more effective than they average bookkeeping and accounting firm.

Account Payable:

A few mistakes on your bookkeeping can seem like no big deal, but when the errors compound it can quickly snowball out of control. Our team of professional bookkeepers can clean up your books and help you keep your bookkeeping look neat and tidy while you continue to run your business. Enjoy accounting support specifically tailored to your business needs.

That is why P&L’s show temporary accounts, these accounts get closed-out in each period because they report recognized revenue and expenses. It might have seemed efficient to have invoices sent directly to one department, billing statements to another, expense reports to still another, and so on. But internal efficiency isn’t your biggest problem at this point.

“Why do my sales not match what I see in my bank account?” Your toughest e-comm A&F questions answered

For efficiency’s sake, remove any unused or necessary accounts from your chart of accounts. This will ensure that it’s organized and accurately shows your business’s current needs. One way to reduce manual Bookkeeping clean up error, increase accuracy, and save time is by using accounting and bookkeeping software. Not only can you reconcile much easier, but you can also automate other processes to reduce human error.

SRJ Cloud Bookkeeping: Cloud Accounting Services for Small and Medium-Sized Businesses – Yahoo Finance

SRJ Cloud Bookkeeping: Cloud Accounting Services for Small and Medium-Sized Businesses.

Posted: Mon, 31 Jul 2023 07:00:00 GMT [source]

A balance sheet is like the report card of your assets, liabilities, and equity. These are permanent accounts that roll on for the life of your business. When you close out a period, your balance sheet displays ending balances in all accounts which become the opening balances for the next period. A P&L shows a detailed snapshot of income for a certain length of time. This is where your opening equity account balance is itemized as gain or loss before it is transferred to equity accounts.

Counting The COGS: Inventory Accounting Guide

These financial events impact the future of your business, so time management is of the utmost importance. Regardless of how far bookkeeping goes back, meet your deadlines by allocating a reasonable amount of time to the project. Revising mistakes will be endless, accuracy isn’t achieved in a week. If you literally keep your records in a shoebox, you probably know that there’s some room for improvement. But if you think that you’re doing just enough to maintain accurate books, you might be whistling through the accounting graveyard. It’s easy enough for minor problems and chronic oversights to go unnoticed for years, but it’s all too easy for them to snowball into serious issues.

As noted, discrepancies can’t always be avoided but correction thereof is key. This requires the skills of an accountant that is able to analyze books and transactions at high-level, and who has insight into the nature of the business. It is advisable that the same accountant, with the expertise to tackle adjustments, executes a clean-up process. Business can track their profit and performance if the cash flow is transparent in the business. A cleaned account book allows the executives and business owners to find out any error from the system before it becomes large. Sometimes lack of such clean-up can even lead to an accounting black hole, which can destroy a business.

Weekly services are included in our most popular bookkeeping packages. If your answer is yes, it’s time to leverage our Financial Health Score – a powerful and free tool that catches 80% of your bookkeeping errors within just a few minutes. Establish an expense tracking system to accurately categorize all of your business expenses. Putting a process in place for reviewing and authorizing expenses can prevent tax filing errors and potential fraudulent activity. Quick fixes, like relying on spreadsheets or delaying record keeping, may seem like a good idea in the short term.

For revenue to be recognized, a business needs to fulfill all performance obligations of a sale. In layman’s terms, you earned a sale, the customer received something of value, and there is proof of exchange within a specified timeframe. Depending on your bookkeeping software, you may be able to automatically categorize transactions as they occur, which helps keep your bookkeeping updated. Before you know it, it’s been months or even (yikes) years, since your bookkeeping has been properly updated. And now the project looms over you like an ominous thunderstorm waiting to strike with disastrous results. Read on to learn the process if you are ready to clean up your accounting mess.

Customer-Centricity is Here to Stay

Making documents like contracts with your clients and vendor reports, the contributing factor to taxable income in each accounting period. As you make your way through your bookkeeping cleanup checklist, you want to ensure that you are up-to-date with paying your taxes. Whether you filed an extension or it’s time to start paying regularly quarterly taxes, your newly organized bookkeeping will help you pay on time and consistently. Paying your taxes quarterly can help you avoid unnecessary fees or sticker shock when your annual taxes come due.

Many business owners get lost here because they make things pile up. All this is to achieve the right strategic layout and balance the financial situation. You need to reconcile your business accounts with the actual expenditures and expenses to get the business on track.

Be vigilant about bookkeeping cleanup and thus keeping your books accurate. Your books provide the basis for your company’s financial health reporting as well as information that guides the future financial decisions you make for your company. There can be a multitude of reasons that the bookkeeping was maintained without adherence to any standards of value or integrity, but excuses don’t fix the problem.